How to Pay Bills Online

Handling Bill Payments

The first and most important rule about bill paying is, actually pay your bills . Nothing is more frustrating then having to pay a late fee for a bill you are already struggling to manage, it's almost ridiculous, but it happens. Your credit rating is also at risk when failing to make those monthly installments, and this can effect how much the world of purchases will cost you in your future life. In short, pay your bills on time every month!

How To Pay Your Bills Online

The outdated bill paying ritual—waiting to receive a bill in the mail, filling out your check, and mailing it back to the creditor—has to be the least effective way to pay bills in our current environment. It cost more over all, it takes more time and energy, and opens you up to greater risk of fraud and identity theft.

So, what is a person supposed to do to make bill paying easier, more effective and safer? Put your pen and paper down, and get your hands and fingers moving on a computer keyboard.

1. Use Direct Deposit

Let the days of going to the bank and manually depositing your paycheck be left behind. At the very least, you should have your paycheck, social security check, and any other recurring income deposited automatically into a bank account. This will save you the time, inconvenience, and gas of going to the bank or teller machine. You will never have the worry of a lost paycheck again. However, the best reason to have your paychecks automatically deposited is because it gets to your account quicker, saving possible late fees on bill paying overdraft mishaps.

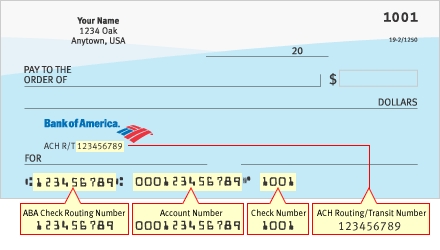

If you are working for an employer, the human resources department, payroll department or your boss, can give you the process information for getting your paycheck deposited directly into your bank account. Most likely the process will require the bank-routing number for the account you choose to deposit into.

Balance Your Bank Account Video (3 min. 58 sec.)

2. Automatic Bill Payments

According to the US Bureau of Labor Statistics, Americans spend more than 22 hours a year paying bills, with the average person paying around 11 bills per month. You can use any or all three of the a, b, c tactics described below to effectively pay your bills automatically. They will consistently save you money, time, and the worry of bad credit ratings. You can immediately start saving the cost of checkbooks, envelopes, and stamps by paying bills automatically using the automatic bill payment methods. The a, b, c methods consist of;

- automatic deductions

- credit cards

- use your computer

a. Automatic Deductions - No Internet required here! Automatically paying bills is best used for very reliable and trusted companies, like your mortgage company. You can set-up a monthly withdrawal or debit from your checking account. All you have to do is give the checking account number to the company you owe and the money will be automatically withdrawn monthly when the due date arrives. With this method, you must make certain your account has enough money at the time of the automatic withdrawal, or those pesky insufficient funds penalties will be applied. It's a good idea to keep a cushion of money in your account, and always sign up for over draft protection. This connects your checking account with a savings account, credit card, or line of credit that automatically funds any overdraft you may encounter, saving you from expensive fees and penalties.

b. Credit Cards - The next way to pay recurring bills is with a credit card, providing the company allows this service. You would preferably use a rewards card that offers small financial reward or points toward airline miles, product merchandise, and other perks. The credit card method also works well to use with merchants you don't know or really trust. Credit card companies offer greater security and consumer protection than most direct-bank debits if a dispute does pop up.

c. Use Your Computer - The final way to automatic bill payment isn't really all that automatic. You use your computer to pay your bills online. You can log on to your banks online banking web site and authorize your bank to make an automatic payment to a company, like the cable company or wireless phone carrier. You have to take the responsibility of making these payments on a regular monthly basis, but some people feel this method gives them a greater sense of managing their money and controlling payment transactions. You can also directly log onto the company's website and make payment there. This method requires a more committed level of organization on your part. But, you can sign up for email reminders to help keep you on task, and who doesn't need a reminder to pay bills?

Snail image compliments of eqcomics.com

3. Prioritize in an Emergency

Nothing is more frightening than change. But, our lives are fraught with it. The loss of a job, divorce, death, vehicle transmission failure, and any other attack on your money wellness can cause the best money managers to tumble swiftly down the financial slope. When these changes occur, it is very easy to lose perspective as to who gets paid and who has to wait for their money.

- Who To Pay First - Think in terms of what you need to sustain your life; food, medications, shelter, utilities, transportation, and clothing that support weather conditions. When things get very real, always consider survival over reputation. You can restore credit ratings at a later point in life. Right now, you have to survive extreme financial life changes.

Tip for starting your emergency fund. (58 sec.video)

- Credit Card Companies Can Be Ruthless- The first thing you may notice is that credit card companies are not listed as a foundation element. Because they are not! Resolve yourself to this right now; credit card companies are going to be the companies that get the most aggressive and nasty when it comes to getting money from you. They may make you feel panicked, as if you must make a payment to them or your life will crash-in around you. This simply is just not the case. Having no food, shelter, heat, or transportation would cause your world to crash-in around you in no uncertain terms. Just stay calm. Of course you owe them money, but making payments for credit card bills, personal loan bills, and even medical bills will have to wait. You will want to immediately place any student loans on hardship deferral. By not letting the credit card companies bully you into giving them your much needed foundation money, you will have more money to use to maintain your immediate needs longer.

- Do What Works Best For You - Feel free to use a combination of all three elements to the bill paying advice. The best thing to do is to find an easy and effective combination for your personal financial well being, keeping it as healthy as possible. Being able to continue the fight later down the financial road is more important than worrying about the "ding" your credit rating is going to take by not paying credit card bills right now. Taking care of your foundation expenses must take priority over all else.

image compliments of careerealism.com

IMPORTANT WARNING:

Using Credit Cards: You must be sure to pay off credit cards monthly when using them as your method of over draft protection. If you can't manage to pay off your credit cards every month, then do not use your credit cards for over draft fee protection. It will end up costing you more in interest charges than the convenience offers.

Automatic Withdrawal: When you stop using a service that you have on the automated withdrawal system, you must notify the company in good time of the change. Otherwise the automated billing will continue, regardless of the discontinued use of the service. It is too easy to simply do nothing and end up needlessly charged month after month for things you don't need or use anymore. Be sure to verify the billing amount of every bill, it's easy to get over charged for billing mistakes when you don't look at the amount of the bill.